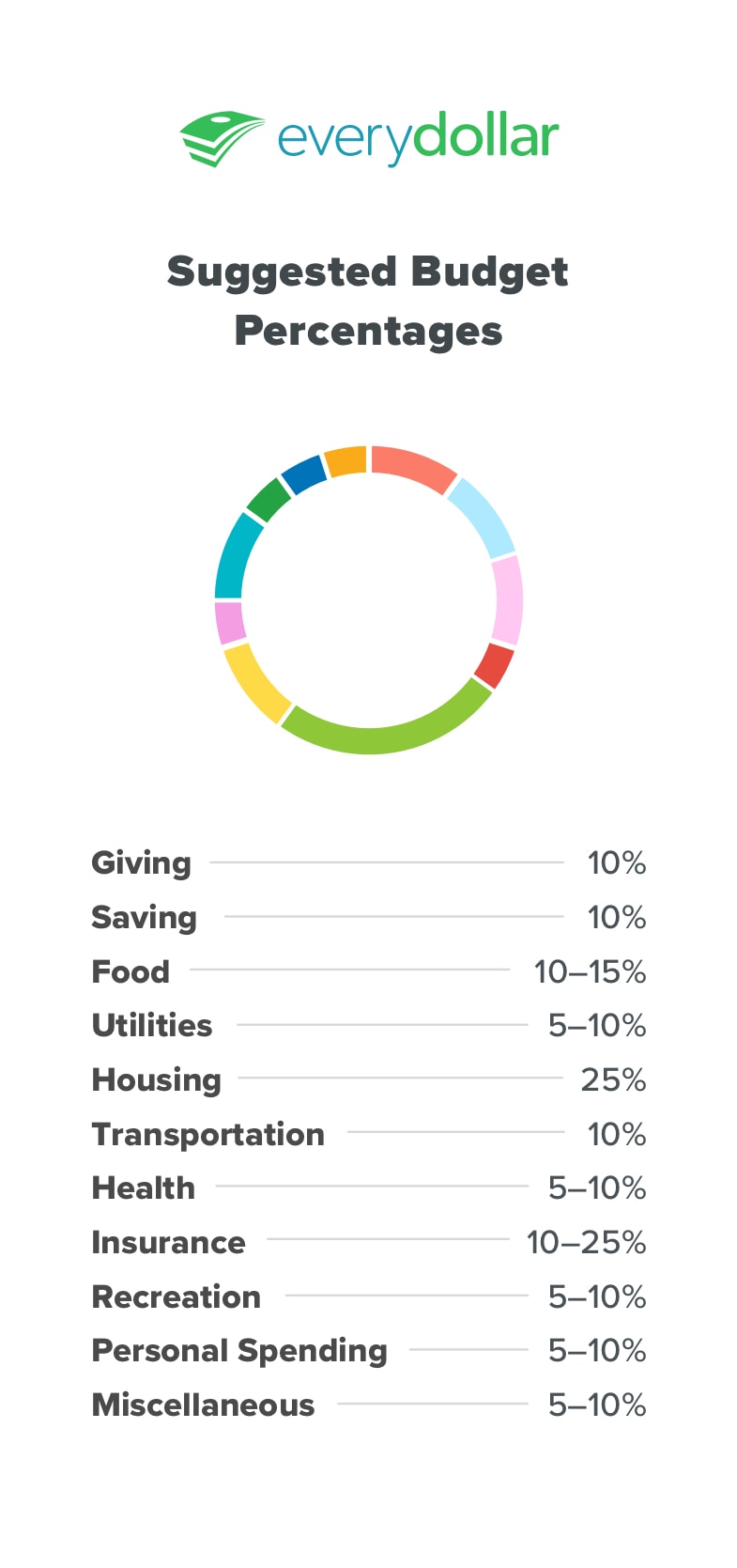

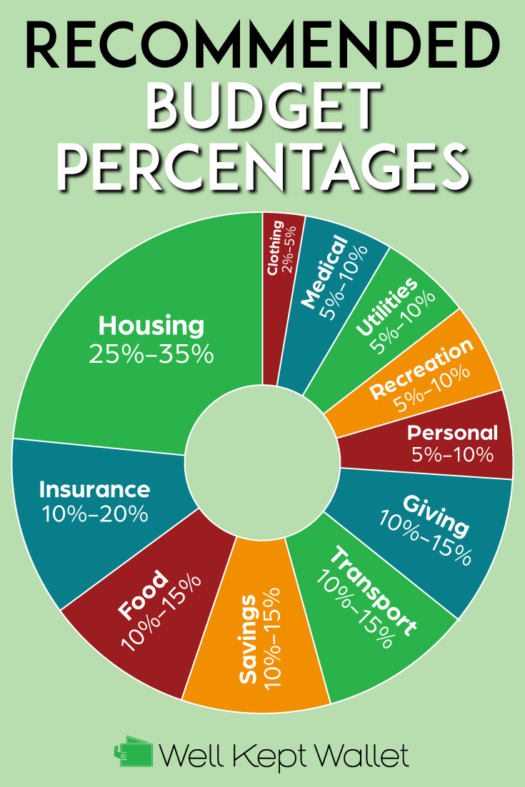

(0.1 percent) and consumer spending increased 18.9 billion (0.1 percent). The 70/20/10 budget rule works by allotting 70% of your income for monthly bills and everyday spending such as cell phones, groceries or utilities, then 20% goes to saving and investing and 10% goes to debt repayment. Personal income, in current dollars, increased in 48 states and the District.-Transportation or auto services: 10-15%.Significant expenditures were housing, transportation and food. -Insurance, such as life, medical, home or auto: 10-25% The average household earned 87,432 in 2021 before taxes and spent 66,928, according to the BLS survey.Though breaking down your budget in percentages is based on your unique financial situation, here is a good general breakdown:.What percentages should you use for your budget?.Education accounted for 26.4 percent of state expenditures in. The remaining 30% of your income is for discretionary spending. Budget 101: How a 23-year-old art teacher makes her budget work each month Income Total: 2,600 monthly Housing, basic expenses House, basic expenses total. In New York in fiscal year 2015, 62.3 percent of total tax revenues came from income taxes. The best evidence we might get might have some type of subjective- ness.

That leaves 50% for needs, including essentials like mortgage or rent and food. A few weeks ago, the New York Times and CBS people indicated 47 percent of the.

0 kommentar(er)

0 kommentar(er)